A senior Walgreens executive and a Disney heir are among the ultra-wealthy Americans calling to be taxed even more to combat global inequality.

John Driscoll, who acts as executive vice president for Walgreens Boots Alliance and is thought to have a net worth of $1.7 million, warned that the American Dream is 'rapidly diminishing' due to rising economic hardship.

He is one of 250 billionaires and millionaires supporting an initiative called Proud to Pay More which is calling on lawmakers across the world to raise levies for their country's richest.

Driscoll joined documentary-maker Abigail Disney - the great-niece Walt Disney - in signing a new letter addressed to the world leaders gathered at the Davos summit.

Explaining his rationale for joining the campaign, he wrote: 'My grandparents emigrated to the United States from the rocky coast of southwest Ireland in the early 20th century to give their children and grandchildren a better life.

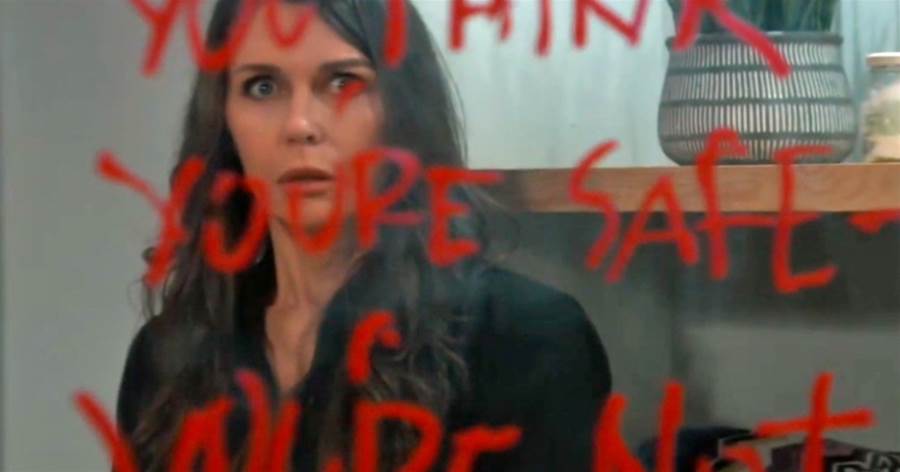

John Driscoll, who acts as executive vice president for Walgreens Boots Alliance and is thought to have a net worth of $1.7 million, warned that the American dream is 'rapidly diminishing' due to rising economic hardship

Driscoll joined documentary-maker Abigail Disney - the great-niece Walt Disney - in urging lawmakers to impose greater taxes on the super rich

'Were it not for their dreams and hard work - my grandfather worked as a janitor and carpenter and my grandmother as a nanny - my family would not have gotten a fresh start.

'The sad truth today is that if my grandparents came to America and tried just as earnestly to get ahead, it's unlikely they would succeed - let alone lay the groundwork for their grandson to become a millionaire.'

He went on to cite a 2022 study from the Economic Policy Institute which found the average American CEO earns 399 times as much as a typical worker.

Driscoll has long been an advocate for higher wages. While CEO of home-health company CareCentrix, the company raised its minimum wage to $15 per hour.

Meanwhile Abigail Disney wrote there was a good chance readers 'recognized my surname' before adding: 'Yes, I am a member of that Disney family.'

She continued that she wanted to be levied harder to support environmentally friendly initiatives.

'We have a responsibility to ensure that our planet is healthy and habitable for future generations.

'In my unique case as a person of wealth, I can only fulfill this responsibility if lawmakers strengthen their resolve to tax me more,' she wrote.

Other individuals to sign the letter included Citibank executive Akshay Singal and ex-Black Rock managing director Morris Pearl.

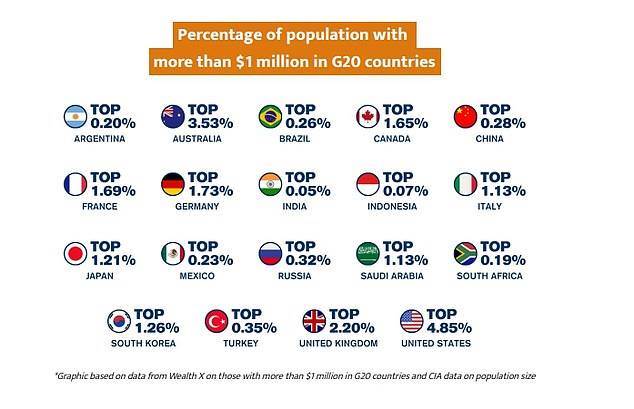

According to Proud to Pay More's research, American has the largest proportion of millionaires of ay G20 country.

Other individuals to sign the letter included Citibank executive Akshay Singal, pictured, and ex-Black Rock managing director Morris Pearl

According to Proud to Pay More's research, American has the largest proportion of millionaires of ay G20 country

Some 4.95 percent of the US population have more than $1 million to their name compared to 2.2 percent of Britons and 3.53 percent of Australians.

has long been a headache for the Internal Revenue Service (IRS).

IRS Commissioner Danny Werfel last year told reporters that budget cuts had made it difficult for agents to tackle the 'complicated methods the wealthiest taxpayers used to hide their income and evade paying their fair share of taxes.'

The organization launched a historic crackdown on ultra-rich tax cheats which saw agents claw back $122 million from the nation's millionaires.

Analysts have long called for greater taxes on the wealthy to benefit the greater population.

Back in October, researchers at the EU Tax Observatory found a 2 percent tax on all of the world's billionaires

The average lifetime cost of owning a home in the US has reached $796,998, according to Investopedia's analysis

The so-called 'American Dream' is the benchmark that many people hope to getting married, buying a home and a car and raising children.

But new has found that achieving these milestones now costs a staggering $3,455,305 - much more than most Americans will make in their lifetime.

One of the biggest amounts is for paying off a mortgage on a property. The average homebuyer will fork out $796,998, according to Investopedia - assuming a 10 percent down payment and a 30-year fixed loan at 7.2 percent interest.